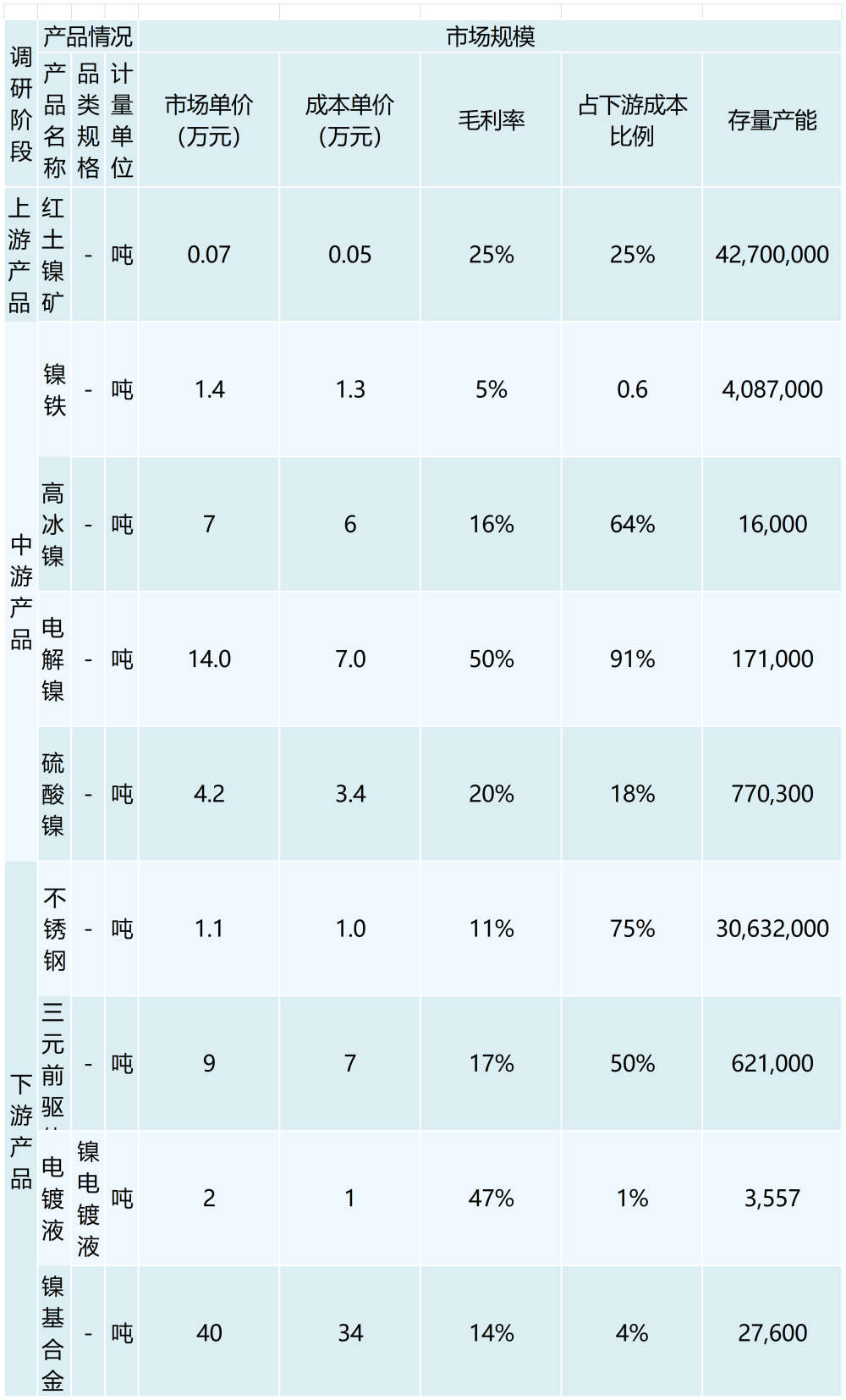

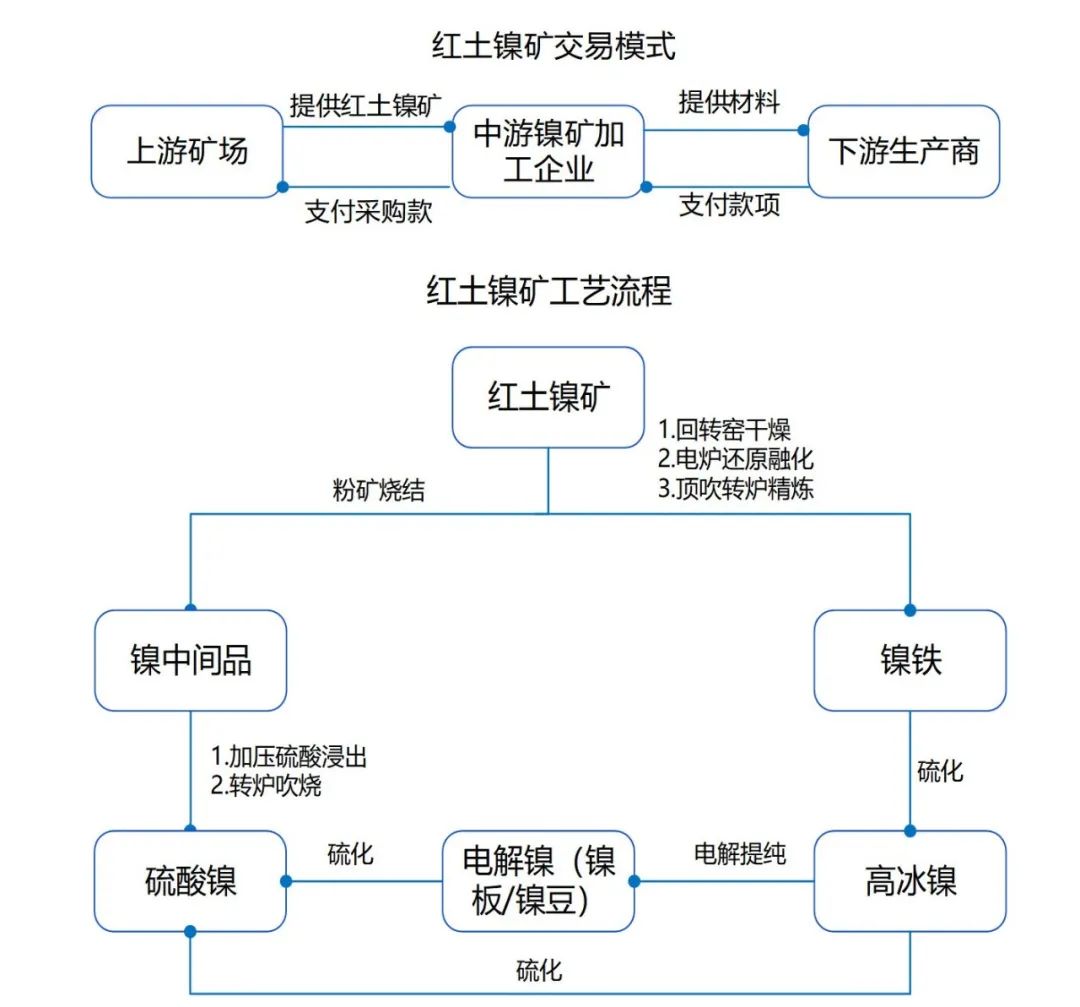

Laterite nickel resources are surface weathered crustal deposits formed by weathering, leaching and deposition of nickel sulphide ore bodies, and are mainly distributed in tropical countries within 30 degrees north and south of the equator line, of which Indonesia, Australia and the Philippines are the three countries with the largest amount of proven laterite nickel reserves, accounting for a total of about 46%. China's nickel reserves are dominated by nickel sulphide ore, and the nickel laterite ore required for production mainly relies on imports from Indonesia and other countries. Laterite nickel ore downstream products are mainly ferronickel, through the ferronickel reprocessed into stainless steel widely used in various fields. In recent years, with the advent of new energy vehicles, the demand for nickel sulfate has accelerated, starting from 2021, nickel laterite ore through the wet process, fire process to form nickel sulfate industry pathway is gradually opened, lower cost nickel laterite ore will gradually replace nickel sulfide to become the mainstream supply of nickel sulfate, to further stimulate the demand for ternary power batteries potential. 2021, China's imports of nickel laterite ore of 42.7 million tons, corresponding to a market size of about 28.0 million tons. In 2021, China's import volume of nickel laterite ore is about 42.7 million tons, corresponding to a market size of about 28 billion yuan, it is expected that the import volume of nickel laterite ore will reach 46.6 million tons in 2022, an increase of 9.1% year-on-year, and the market size will reach 30.5 billion yuan. With the continuous development of new energy automobile industry, it is expected that the demand for nickel laterite ore will be further enlarged in the future.