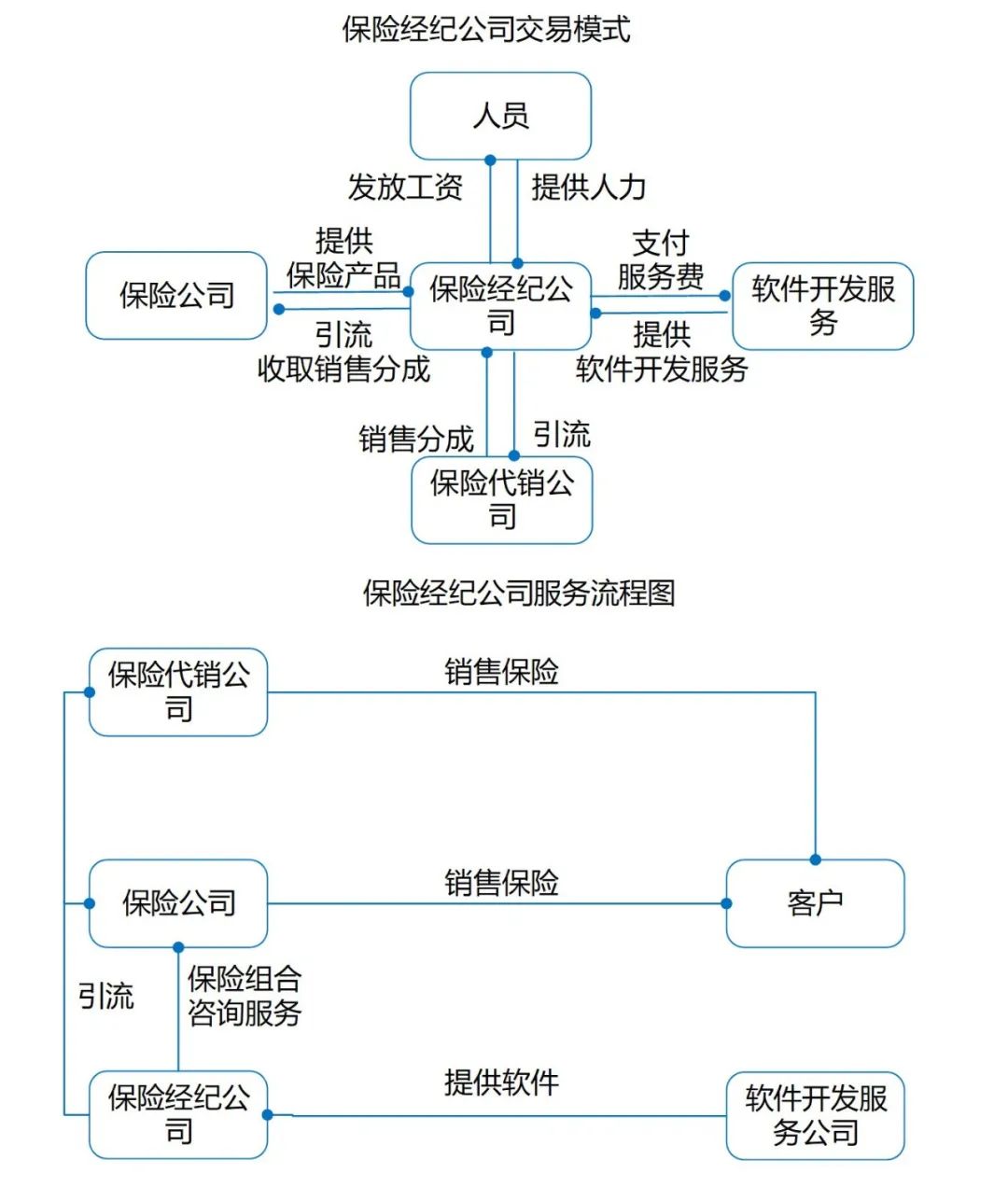

An insurance broker is one of the insurance organizations that enter into insurance contracts with insurance companies for the benefit of policyholders. The main business of insurance brokers is to provide professional risk management services, design insurance plan, handle insurance procedures, etc. Insurance brokers usually stand on the consumer's point of view, matching suitable and cost-effective insurance products for consumers. Advantages of insurance brokers - more comprehensive services, insurance brokers are mostly online services, services are more convenient and fast. The services provided by insurance brokers include one-stop services such as preliminary introduction of insurance knowledge, product analysis and evaluation, analysis of the needs of the insured, and finally assistance in claims settlement. Insurance brokers play an active role in the insurance market, which is conducive to accelerating the process of domestic insurance industry's international integration, further improving the insurance market, as well as safeguarding the interests of the policyholders, and promoting fair trade and orderly competition in the insurance market. As of June 2021, there were less than 500 insurance brokerage companies in China, and the license is extremely scarce. The business market scale of China's insurance brokerage industry in 2021 was about 27 billion yuan, and with the continuous development of the insurance brokerage industry, the market scale of China's insurance brokerage business in the future will reach hundreds of billions of yuan.